Saving Money is a good habit and should be inculcated by youngsters naturally. Saving money should be a part of monthly budget. A healthy saving comes handy in times of dire need. Hence, we will know about the best investment options for youngsters.

There are numerous choices of investment options for youngsters, accessible for reserve funds, and the most ideal decision for you will rely upon your monetary objectives, your gamble resistance, and how rapidly you want admittance to your cash.

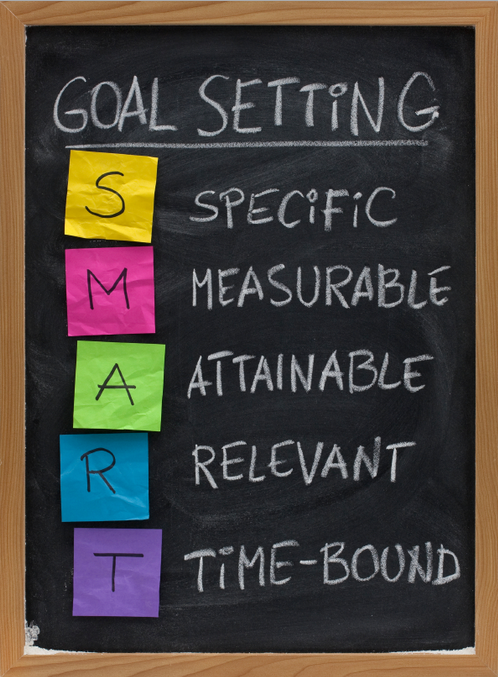

While planning for your Budget be clear on your Goals, which can be achieved by following the SMART Goal setting method.

Listed below are some investment options for youngsters :

1. High-yield savings accounts – one of the investment options for youngsters

A high return bank account is a sort of investment account that offers a higher loan fee than a customary bank account. These accounts, which are offered by banks and other financial institutions, are becoming increasingly popular with savers who want to increase their savings’ return.

The higher interest rate offered by a high-yield savings account is one of its primary benefits. High-yield savings accounts may offer rates of up to 1% or more in comparison to the interest rates offered by traditional savings accounts, which range from 0.05% to 0.1 percent. This implies that your investment funds will acquire more revenue after some time, which can include fundamentally over the long haul.

The fact that high-yield savings accounts are typically insured by the FDIC, which means that your money is protected up to $250,000 per account, is another advantage of these accounts. Savers who are concerned about the safety of their funds may find this to be reassuring.

While high-yield savings accounts can be a good choice for those who want to earn more interest on their savings, it’s important to know about any fees or minimum balance requirements. Moreover, the loan fees presented by high return investment accounts can vary over the long run, so it’s vital to watch out for your record and be ready to change to an alternate reserve funds choice if important.

2. Certificates of deposit (CDs)

The second of the investment options for youngsters is CDs or Certificates of Deposits. Banks and other financial institutions offer CDs, a type of savings account with a fixed interest rate for a predetermined amount of time. Cds normally offer higher loan costs than customary investment accounts, yet the trade off is that your cash is secured for a set time frame, typically going from a couple of months to quite a while.

A benefit of CDs is that they guarantee a return on your investment, letting you know precisely how much interest you will earn over the CD’s term. If you want to get a higher rate of return on your savings but don’t want to take the risk of investing in the stock market, this might be a good choice for you.

The fact that CDs are insured by the FDIC, which means that your money is safe up to $250,000 per account, is another advantage of CDs. Savers who are concerned about the safety of their funds may find this to be reassuring.

CDs, on the other hand, have a few drawbacks as well. One disservice is that your cash is secured for a set timeframe, and that implies that you will most likely be unable to get to your assets assuming you really want them before the term of the Cd is up. In addition, CD interest rates may be lower than those of mutual funds or stocks, whose potential returns are comparable.

It’s critical to shop around for the best interest rates and terms when considering a CD. For longer-term CDs, some banks and credit unions may offer higher rates, while others may offer greater flexibility regarding early withdrawal penalties. A CD’s integration into your overall investment strategy and consideration of your financial objectives and time horizon are also critical considerations.

3. Money market accounts

Money market accounts, or MMAs are one of the third available investment options for youngsters. They are a type of savings account that typically have more restrictions on withdrawals and account minimums but offer interest rates that are typically higher than those of traditional savings accounts. MMAs are similar to savings accounts in that they are FDIC-insured up to $250,000 per account, and they are typically offered by banks and credit unions.

MMAs have the advantage of offering higher interest rates than standard savings accounts while maintaining a high liquidity level. This implies that you can get to your assets moderately effectively assuming you really want to, however you will likewise procure a better yield on your investment funds.

Another advantage of MMAs is that they frequently provide tiered interest rates, allowing you to earn a higher interest rate as your balance grows. You may be able to earn more interest over time and use this as an incentive to save more money.

However, MMAs have a few drawbacks as well. One drawback is that, in comparison to conventional savings accounts, they frequently necessitate a higher minimum balance, and there may be penalties for dipping below the minimum balance. Additionally, the amount of money you can withdraw or transfer from the account each month may be limited, limiting your flexibility.

It’s critical to shop around for the best interest rates and terms when considering an MMA. Look for accounts with flexible withdrawal options, reasonable minimum balance requirements, and low fees. Additionally, ensure that you carefully read the account disclosures to learn about any account-related restrictions or penalties.

4. Retirement accounts

A type of investment account called a retirement account is meant to help people save for retirement. Traditional individual retirement accounts (IRAs), Roth IRAs, 401(k) plans, and pension plans are among the various types of retirement accounts. This is one of the available investment options for youngsters.

The tax advantages that retirement accounts provide are one of their primary benefits. Typically, contributions to 401(k) plans and traditional IRAs are tax-deductible, allowing you to lower your taxable income and potentially lower your tax bill. You won’t have to pay taxes on the gains until you withdraw them in retirement because these accounts’ earnings grow tax-deferred. On the other hand, Roth IRAs are funded after taxes, but the earnings grow tax-free, so you won’t have to pay any taxes on the gains.

One more advantage of retirement accounts is that they provide a wide range of investment options, which can assist you in diversifying your portfolio and increasing your chances of long-term returns. A retirement accounts offer the capacity to put resources into individual stocks or common assets, while others might offer deadline reserves or other expertly overseen speculation choices.

Retirement accounts, on the other hand, come with a few restrictions and limitations as well. In addition, there is always the possibility of losing money in the event that the market declines, and there may be contribution limits and eligibility requirements, as well as penalties for withdrawing funds before the age of 59 12.

It is essential to comprehend your options when considering a retirement account and select the one that best suits your financial objectives and requirements. Consider your age, income, and retirement objectives, and if necessary, seek advice from a financial professional. Additionally, if your employer offers matching contributions, make sure to take advantage of them and contribute as much as you can afford to the account each year.

5. Health savings accounts (HSAs)

Another opportunity among the various investment options for youngsters, is a type of tax-free savings account called a health savings account (HSA) is meant to help people pay for medical bills. They are available to people who have health insurance plans with high deductibles. Contributions to the account can be made before taxes are paid or through payroll deductions.

The triple tax benefit that HSAs provide is one of their primary benefits: Earnings grow tax-free, withdrawals for qualified medical expenses are tax-free, and contributions are deductible or pre-tax. For individuals with high medical costs, this may offer a significant tax benefit.

The portability and adaptability of HSAs is yet another advantage. An HSA account can be used to pay for qualified medical expenses like deductibles, copayments, and prescriptions. However, after the age of 65, the funds can also be used to pay for non-medical expenses without incurring a penalty (though they will be taxed). Also, because HSAs are portable, you can take them with you when you change jobs or health insurance plans.

HSAs, on the other hand, come with a number of limitations and restrictions. An HSA, for instance, can only be used if you have health insurance with a high deductible and there are annual contribution limits. Additionally, you may be penalized by 20% if you use the funds for non-qualified expenses before age 65.

Understanding the account’s rules and restrictions is essential when considering an HSA. Choose a health insurance plan with a high deductible that is eligible for an HSA and contribute as much as you can afford to the account each year. Additionally, you should keep track of your medical expenses and save your receipts because these will be required to demonstrate that your withdrawals were made for eligible expenses. Due to the limitations of this type of saving, this option is not a particularly favorite option among all the investment options for youngsters.

6. Brokerage accounts

A brokerage account is a type of investment account that allows you to buy and sell securities, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These accounts are typically offered by brokerage firms, such as Charles Schwab, Fidelity, and E-Trade.

One of the key advantages of a brokerage account is that it offers a wide range of investment options. You can invest in individual stocks or bonds, mutual funds or ETFs, and other securities. This can help you diversify your portfolio and potentially earn higher returns over the long term.

Another advantage of a brokerage account is that it offers flexibility and control. You can choose the investments that you want to buy and sell, and you can make changes to your portfolio at any time. Additionally, some brokerage accounts offer online tools and resources to help you research and analyze investment options.

However, there are also some risks associated with brokerage accounts. The investments in the account are not guaranteed, and there is always the risk of losing money if the market declines. Additionally, some brokerage accounts may charge fees, such as commissions or account maintenance fees, which can eat into your returns.

When considering a brokerage account, it’s important to understand the risks and fees associated with the account. Make sure to choose a reputable brokerage firm and research the investment options available. Additionally, consider factors such as your investment goals, risk tolerance, and time horizon, and seek advice from a financial professional if necessary. Finally, keep in mind that brokerage accounts are not a substitute for emergency savings or other types of accounts designed to meet specific financial goals.

7. Investments in Real Estate

In the United States, there are a variety of ways to invest in real estate, each with its own benefits and drawbacks. The most typical kinds of real estate investments are as follows:

Real Estate for Rent: For people who want a steady stream of income, rental properties are a popular choice for an investment. A single-family home, multi-family apartment building, or commercial property can be purchased by investors and rented to tenants. A steady stream of passive income can be provided by the property’s rental income.

Flipping Houses: Flipping houses includes buying a property, redesigning it, and selling it for a benefit. This methodology can give a speedy profit from venture, yet it likewise requires a lot of forthright capital and information on the neighborhood housing market.

Trusts for Real Estate Investment (REITs): REITs are organizations that own and deal with an arrangement of pay producing land properties. Shares in a REIT can be purchased by investors, allowing them to invest in a diverse portfolio of properties without having to manage them. Regular dividends and capital appreciation can be provided by REITs.

Crowdfunding for Real Estate: Investors can pool their funds to invest in real estate projects through crowdfunding. The crowdfunding platform typically takes care of the property management and legal work for investors, so they can choose which projects they want to invest in. Crowdfunding can give admittance to a more extensive scope of land speculation potential open doors, however it likewise accompanies a few dangers, like absence of command over the venture.

Partnerships in Real Estate: Multiple investors can pool their resources to purchase and manage a property through real estate partnerships. Typically, each investor shares in the property’s profits and losses as well as a portion of the capital. Although real estate partnerships can provide access to larger and more profitable properties, they also necessitate extensive partner coordination and communication.

Before making a decision regarding an investment, it is essential to investigate and weigh the pros and cons of each type of real estate investment. To ensure a successful investment, it is also essential to have a solid comprehension of the local real estate market and to collaborate with seasoned professionals like real estate agents, property managers, and attorneys.

Conclusion

Youngsters and particularly young married couples, who have big dreams should make savings a part of their life. All in all, there are a few investment options for youngsters in the USA, including high return bank accounts, declarations of store (Discs), currency market accounts, retirement accounts, well being investment accounts (HSAs), and money market funds. Every investment funds choice has its own arrangement of benefits and dangers, and youthful couples should assess their monetary objectives and hazard resistance while picking a reserve funds choice.

A secure and simple means of increasing savings interest rates are high-yield savings accounts. CDs offer a low-risk strategy for increasing interest rates over a predetermined time period. Higher interest rates and simple fund access are offered by money market accounts.

Benefits from taxes and a way to save for retirement are offered by retirement accounts like 401(k)s and IRAs. Saving for medical expenses and lowering taxable income can be accomplished through HSAs. Money market funds give a potential chance to long haul speculation development.

To achieve their financial objectives and diversify their savings, young couples should consider a variety of investment options. To ensure a successful savings strategy, it is essential to investigate, analyze, and collaborate with financial professionals. Young couples can establish a solid financial foundation for the future by starting early and investing wisely.